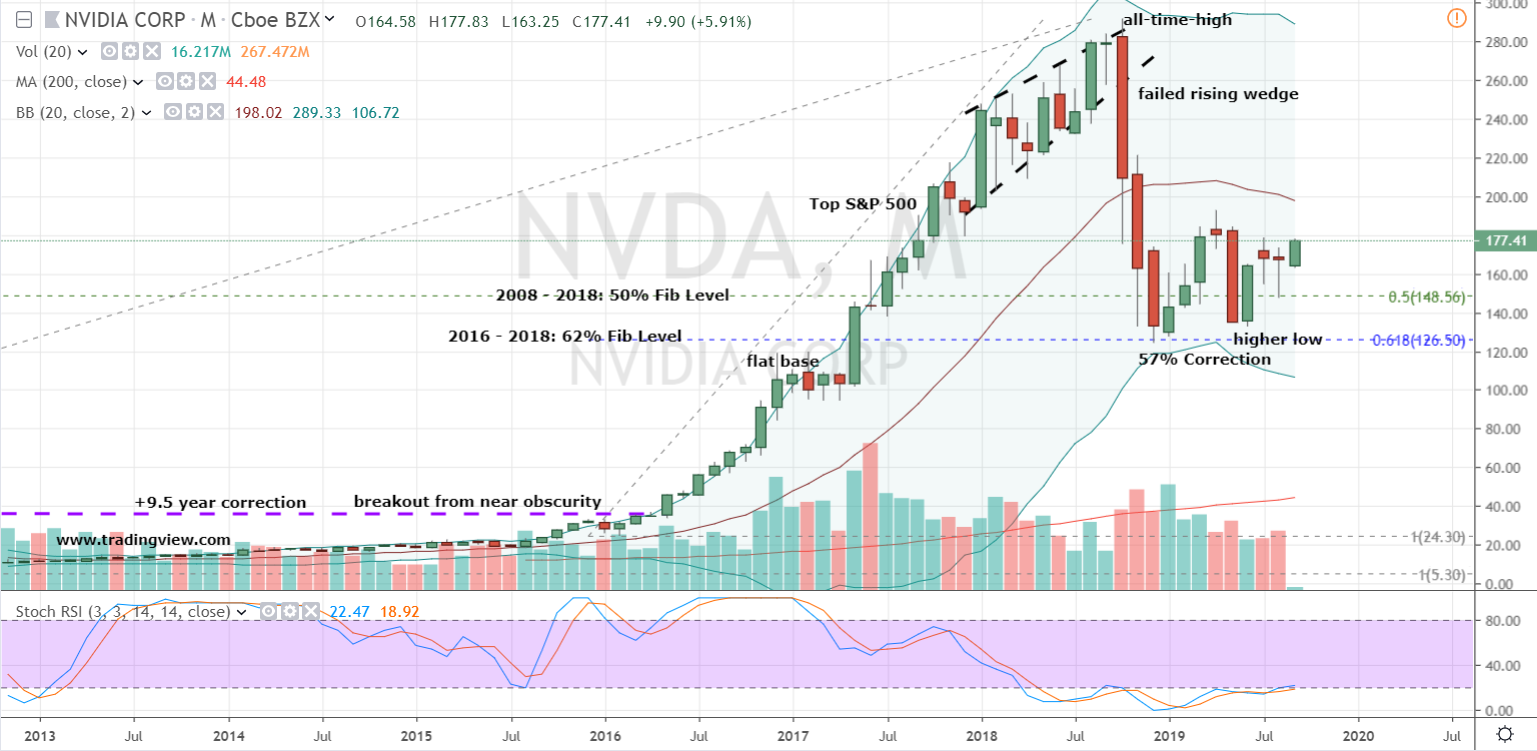

This is considered to be a good technical signal. Furthermore, there is a buy signal from the 3 month Moving Average Convergence Divergence (MACD). Further rise is indicated until a new top pivot has been found. A buy signal was issued from a pivot bottom point on Friday, October 14, 2022, and so far it has risen 17.36%.

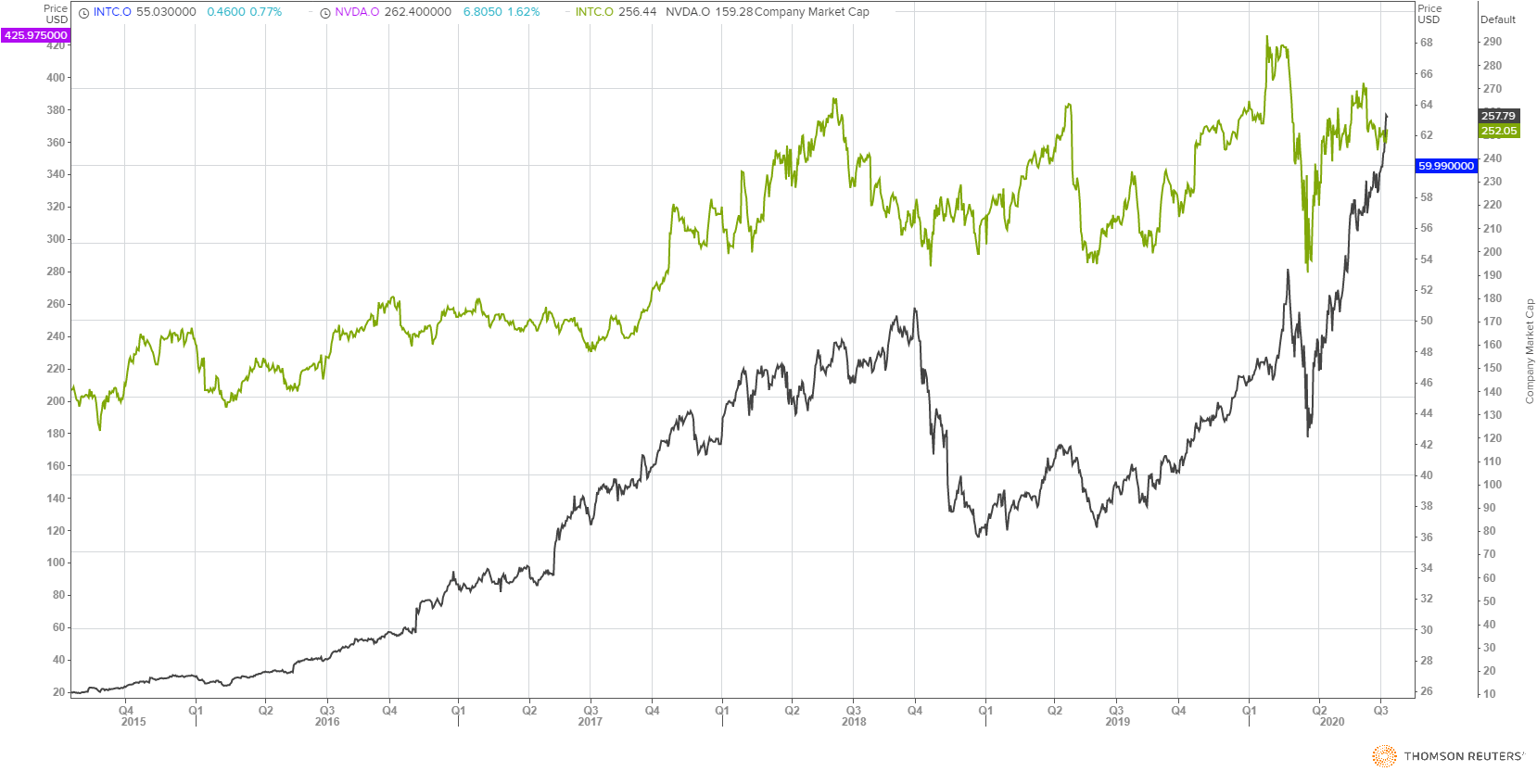

A breakdown below any of these levels will issue sell signals. On corrections down, there will be some support from the lines at $126.63 and $126.41. Also, there is a general buy signal from the relation between the two signals where the short-term average is above the long-term average. The NVIDIA stock holds buy signals from both short and long-term moving averages giving a positive forecast for the stock. Its platforms address markets such as Gaming, Professional Visualization, Data Center, and Automotive.Mostly positive signals in the chart today. Its Compute & Networking segment includes Data Center platforms and systems for artificial intelligence (AI), high-performance computing (HPC), and accelerated computing Mellanox networking and interconnect solutions automotive AI Cockpit, autonomous driving development agreements, and autonomous vehicle solutions and Jetson for robotics and other embedded platforms. Its Graphics segment includes GeForce graphics processing unit (GPU), the GeForce NOW game streaming service and related infrastructure, and solutions for gaming platforms Quadro/NVIDIA RTX GPUs for enterprise workstation graphics virtual graphics processing unit (vGPU) software for cloud-based visual and virtual computing and automotive platforms for infotainment systems. It operates through two segments: Graphics and Compute & Networking. Nvidia Corporation is an artificial intelligence computing company.

0 kommentar(er)

0 kommentar(er)